RANDOM PROCESSES PDF

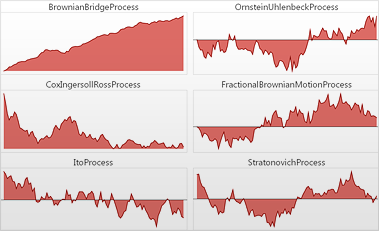

Based on your knowledge of finance and the historical data, you might be able to provide a PDF for $S(t_1)$. Note that at any fixed time $t_1 \in [0,\infty)$, $S(t_1)$ is a random variable. Here, $S(t)$ is an example of a random process. Figure 10.1 shows a possible outcome of this random experiment from time $t=0$ to time $t=1$.įigure 10.1 - A possible realization of values of a stock observed as a function of time. Here, we assume $t=0$ refers to current time. In particular, let $S(t)$ be the stock price at time $t\in[0,\infty)$. For example, suppose that you are observing the stock price of a company over the next few months. … this book will continue to be among the most useful and popular books on the subject in the decades to come." (Jordan M.In real-life applications, we are often interested in multiple observations of random values over a period of time. Thus the comprehensive content and the masterly written text make the book attractive for researchers in stochastic analysis and its applications as well as for graduate students in the area. … The reference list is also updated with essential recently published papers and books. "For several reasons stochastic analysis has been among the scientific hits of the last few decades. … The very detailed exposition of the text will in particular appeal to the mathematically interested reader and scientist." (Metrika, July, 2002) The ambitious program of the authors was to give for the first time a systematic account of the stochastic calculus and the unifying power and efficiency of its methods for the study of statistics of random process. "This is the revised and expanded second edition of the first version in Russian of (1974) and in English (1997, 1978). "The first volume of the books may also be used as an advanced graduate-level textbook for a course in stochastic processes…" It is conceivable that these books will have a significant impact on the aforementioned fields and will become classics." With the new additions and modifications of the first edition, they are to be welcomed and benefit not only the systems theory and control community but also mathematicians working on stochastic processes engineers in control, communication, and signal processing researchers in financial engineering and scientists in many other related fields.

Providing clear exposition, deep mathematical results, and superb technical representation, they are masterpieces of the subject of stochastic analysis and nonlinear filtering…What is special about these books is their broad coverage and in-depth study of optimal filtering problems…The books can be used by researchers in different areas who need to use stochastic calculus and who treat state estimation, detection, and stochastic control problems under incomplete information and partial observations…These two books are a comprehensive treatise on stochastic calculus, random processes, and filtering theory, and provide an excellent and illuminating introduction to these fields with a wide range of theoretical and practical issues. "Written by two renowned experts in the field, the books under review contain a thorough and insightful treatment of the fundamental underpinnings of various aspects of stochastic processes as well as a wide range of applications. These two classic volumes are very important resources for both probabilists and statisticians." "The material is accessible to researchers and advanced graduate students. JOURNAL OF THE AMERICAN STOCHASTIC ASSOCIATION Moreover, in each chapter a comment is added about the progress of recent years. In the second edition, the authors have made numerous corrections, updating every chapter, adding two new subsections devoted to the Kalman filter under wrong initial conditions, as well as a new chapter devoted to asymptotically optimal filtering under diffusion approximation. The theory of martingales presented in the book has an independent interest in connection with problems from financial mathematics. The book is not only addressed to mathematicians but should also serve the interests of other scientists who apply probabilistic and statistical methods in their work. The required mathematical background is presented in the first volume: the theory of martingales, stochastic differential equations, the absolute continuity of probability measures for diffusion and Ito processes, elements of stochastic calculus for counting processes. The subject of these two volumes is non-linear filtering (prediction and smoothing) theory and its application to the problem of optimal estimation, control with incomplete data, information theory, and sequential testing of hypothesis.

0 kommentar(er)

0 kommentar(er)